Shenzhen Banking News

Difference Between an Accountant and a Bookkeeper

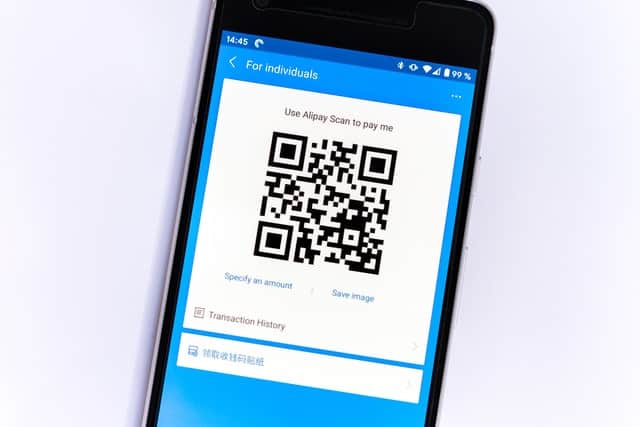

How to Setup and Use Mobile Alipay (Zhifubao) in China

Neat HK: A Solution for the Hong Kong Banking Nightmare?

Differences in Corporate Tax vs Personal Tax for International Entrepreneurs

Features to Look For In Your Hong Kong Bank

Amazon + Hong Kong – Match Made in Heaven

Hong Kong Visas & Immigrations with Stephen Barnes

Can You Apply For A HK Bank Account Online?

Setting Up Your Bookkeeping in Hong Kong

Belize or Hong Kong Company Structure?

Using Hong Kong For Your Import/Export Company

Why You Need a Hong Kong Company Credit Card

Did you know you can withdraw RMB from Hong Kong ATMs?

What to do if you lose your ATM card in Shenzhen