Last week we analised how to calculate in a quick and simple way the amount of tax you have to pay in China. Don’t worry if you missed it!

Read more about How to calculate Personal Income Tax (PIT) in China- Part 1

This week we would like to explain why the after-tax income decreases over time.

This is because the PIT is calculated by a tax bracket percentage on an accumulative basis.

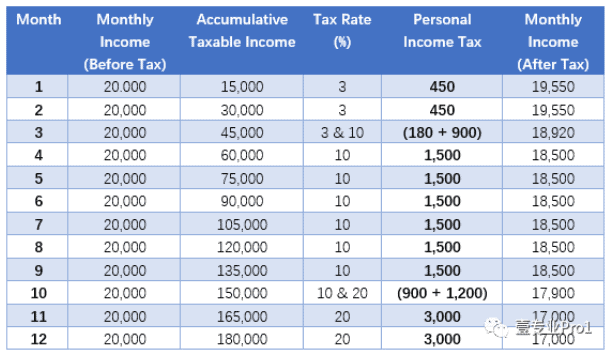

Carrying on from the example above, below is a breakdown of personal income tax on a monthly basis:

*Accumulative Taxable Income refreshes to 0 every January

(Start of a new fiscal year –Accounting law of PRC)

Total Personal Income Tax: 19,080RMB

Therefore, it is not quite feasible for acompany to state a fixed after-tax monthly salary on the contracts, and pay the employee a fixed after-tax monthly salary, unless they must adjust the before-tax income every now and then or divide a portion of income as cash allowance.

*Important Notice* It is highly recommendedto check with your current employer to make sure that they help pay for your personal income tax on monthly basis throughout the 1-year contract (Via the government’s online tax declaration system). Otherwise, it would affect your work permit extension on the following year and may cause difficulties on wire transferring your income back home.

Here are some red flags to be aware of:

1) Receiving 80-100% salary by cash payments

2) Wire transfer of more than 80-100% salary by an individual (Not by the company that you’re working for)

3) Contract that stipulates after-tax salary

Here is an example of a “Personal Income TaxProof” issued by the tax bureau:

For more information or to inquire for a job, feel free to contact us directly or visit www.pro1hr.com