With the implements of the new Chinese Individual Income Tax Law and relevant regulations from January 1, 2019, there are some changes for tax calculation for expats either on salaries or annual bonuses. Recently many companies will pay annual bonuses to employees, but some use the wrong formula or don’t know how to calculate. Today we will discuss tax calculation for annual bonus.

Tax calculation is different for resident taxpayer and non-resident

taxpayer.

Definitions:

1.Resident Taxpayer

An individual who has domicile or resides in mainland China for more than 183 days per tax year (January 1 to December 31) will be classified as a resident taxpayer.

2. Non-resident Taxpayer

An individual who has no domicile or resides in mainland China for less than 183 days per tax year will be classified as a non-resident taxpayer.

Resident

Bonus Tax

There are two methods to calculate resident taxpayer’s annual bonus tax before January 1, 2022.

Method One.

This is the old calculation method before the implement of new Chinese IIT law and is valid till January 1, 2022.

Under this method, lump-sum annual bonus is calculated and taxed separately from other comprehensive income, according to the formula below.

Annual bonus tax= Taxable income*applicable tax rate-quick deduction

Taxable income= Annual bonus/12

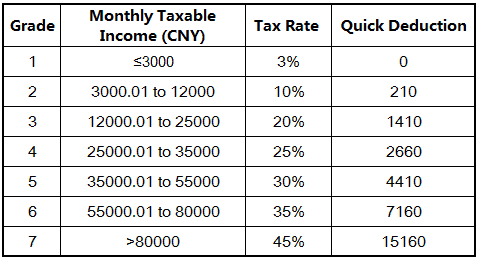

The employer should first divide the annual bonus by 12 and find the corresponding tax rates shown as below:

New IIT Rate Table III

E.g. One resident individual’s annual bonus is 50,000RMB, annual bonus’ tax is:

Taxable income=50000/12=4166.67.

Applicable tax rate:10%. Quick Deduction: 210.

Bonus Tax= 50000*10% -210=4790.

Bonus after tax=50000-4790=45210.

This calculation method only can be used once a year. E.g. Company pays bonus 20,000CNY in February and 100,000CNY in December, better to use this calculation for December’s bonus and calculate February’s bonus together with February’s salary.

Method Two.

It’s new calculation method after the implement of Chinese new IIT law and relevant rules. The annual bonus will be looked as comprehensive income.

When a company pays salaries and bonuses to a resident individual, the IIT amount must be computed using the cumulative withholding method, with the IIT withheld on a monthly basis. Under the cumulative withholding method, the IIT amount to be withheld for the current period should be the balance of the cumulative IIT withholding amount, with the cumulative tax credit and the cumulative IIT amount that has already been deducted. To calculate the cumulative IIT withholding amount until the current period:

• First, calculate the taxable income amount subject to cumulative withholding by deducting various items – including the cumulative tax-exempt income, the cumulative deduction expenses, cumulative special deductions, cumulative special additional deductions and cumulative

other deductions determined pursuant to the law –from the taxpayer’s cumulative income from salaries and bonuses for the tax year derived from employment up to the current month;

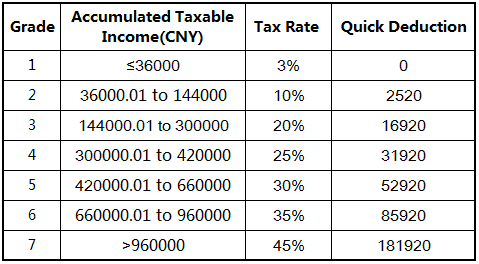

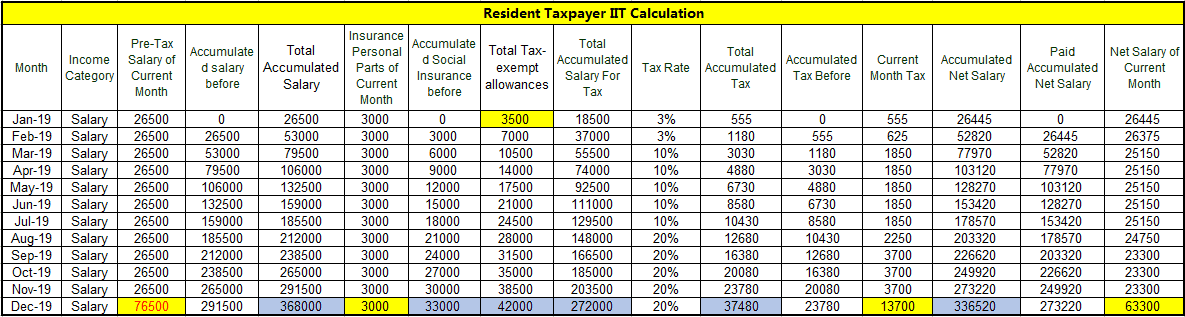

• Second, apply the applicable withholding rates and quick deductions stipulated in the IIT Rates Table I as below:

New IIT Rate Table I

E.g. One resident individual’s annual bonus is 50,000RMB, will be paid in December, 2019. Monthly salary is 26500RMB and monthly tax-exempt allowance is 3500RMB, monthly social insurance personal amount is 3000RMB. How to calculate the bonus tax:

First, Calculate accumulated taxable income.

Total income from January to December is: 368000(=26500*12+50000)

Total deductions:

Accumulated social insurance personal amounts from January to December is: 36000(=3000*12).

Threshold from January to December is: 60000(=5000*12).

Total accumulated salary(whole year income) for tax is: 272000

(=368000-36000-60000)

Second, Calculate IIT.

Tax rate is: 20%, Quick is 16920.

Total Accumulated Tax(whole year tax) is: 37480(=272000*20%-16920)

Accumulated Net Salary(whole year net salary) is: 336520

(=368000-3000-33000-37480+42000)

Current Month Tax (December IIT): 13700(=37480-23780)

Net Salary of December: 63300 (=336520-273220)

or (=76500-3000-13700+3500)

The above calculation method is for resident taxpayer’s comprehensive income ( includeing 1. Wages and salaries 2. Remuneration 3. Author’s remuneration ; 4. income from royalties. ).

Non-Resident

Bonus Tax

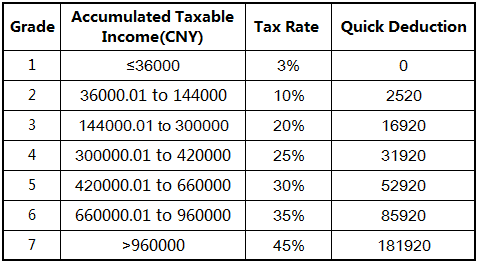

Non-resident annual bonus will be calculated on multi-month bonus method, formula is as below:

Bonus Tax= [(bonus income ÷ 6)×applicable tax rate-quick deduction]×6

IIT Rate Table is as below:

New IIT Rate Table III

E.g.:

John is a non-resident tax payer, he gets 50000RMB annual bonus in Dec, 2019. How much is his bonus tax?

Taxable income:=50,000/6=8333.33

Applicable tax rate is: 10%, Quick deduction is: 210.

Bonus Tax=[(8333.33*10%-210)*6]=3740

Bonus after tax=50000-3740=46260.

This calculation method also only can be used once a year.

It seems that non-resident tax payer’s bonus tax is less than that of resident taxpayer. But it’s not true. It depends on bonus amount.

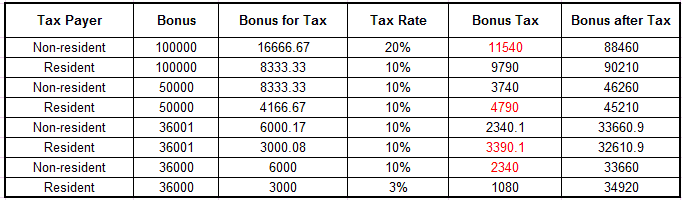

Here are some comparison:

The above calculation for resident taxpayer is based on method one.

Legal Texts:

1. Article I from CaiShui No. [2018]164 ‘Notice of the State Administration of Taxation on the Connection of Preferential Policies after the Amendment of the Individual Income Tax Law’

财税〔2018〕164号 《税务总局关于个人所得税法修改后有关优惠政策衔接问题的通知》第一(一)条。

Offcial link:

https://shenzhen.chinatax.gov.cn/sztax/xwdt/ztzl/grsdsggzt/gszcwj/201812/313885c2ad314f5db30a3b832637f38e.shtml

2. Article III from SAT Announcement No. 35 of 2019

税务总局公告2019年第35号《税务总局关于非居民个人和无住所居民个人有关个人所得税政策的公告》第三-(二)-2条。

Offcial link:

https://shenzhen.chinatax.gov.cn/sztax/zcwj/zxwj/201903/9fb100b9cc6141e7a622a37906e63a8f.shtml

3. Article II from Interpretation of the Announcement of the State Administration of Taxation on Issuing the “Administrative Measures for Withholding Declarations of Individual Income Taxes (Trial)”

《国家税务总局关于发布〈个人所得税扣缴申报管理办法(试行)〉的公告》的解读第二条第(一)项。

Official link:

https://shenzhen.chinatax.gov.cn/sztax/zcwj/zcjd/201902/ee3e08d806dd42e78234af9b28a161dc.shtml

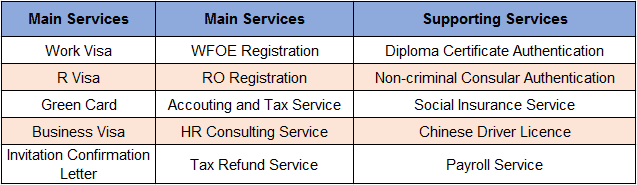

We provide payroll, IIT consultation, HR agency and other relevant services.

Feel free to contact us for details.

Contact: Olivia

Shenzhen ZIX Consulting Co., Ltd

Shenzhen Creative Human Resource Management

Co., Ltd.

Email: [email protected]

Skype: olivialcr

Mobile (WeChat): 13684991963

Public Account: ZixConsulting

Address: Room 18NO, Block B, Fortune Plaza, No. 7002, Shennan Road, Futian District, Shenzhen.