I was talking to a client the other day about setting up a college education fund for his two and four-year-old, and he mentioned that he would like both of them to attend top tier universities in the US. Fair enough, that’s probably the desire of many parents out there.

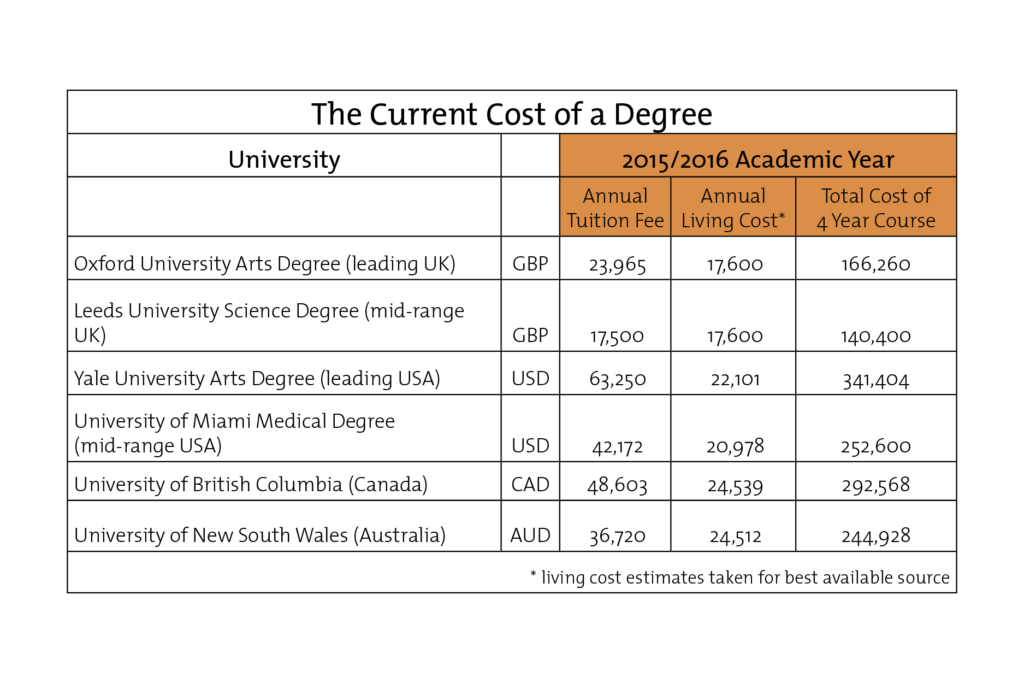

Using Yale as an example, the cost (room, board, tuition, fees, books, etc.) per student is a jaw dropping 63,250 USD per year! When you include living expenses, extracurricular activities, travel/study abroad, and even a little bit of money to burn on the weekends, this number rises to 85,351 USD per year. Once it’s all said and done, a four-year degree at Yale can cost nearly 350,000 dollars. To make matters even scarier, this outrageous figure doesn’t include the fact that school tuition fees increase around 3-5% per year!

In the event your child doesn’t get accepted to Yale, the average cost is still extremely high. In the US, it’s about 20,000 USD per year per student, and around 50,000 USD if you include extra money for the aforementioned activities/living expenses. And then there’s always the possibility of graduate school: MBA’s, PhD’s and other prestigious acronyms that can be added to their names will eat into your savings.

My client, on the other hand, had a backup plan. “Trey,” he stated, “to be honest I’m not worried about financing my kids’ college because I’m sure they’ll get scholarships! My daughter is a music wiz and my son will for sure be a great [American] football player… he’s got an incredible arm for his age!”

While I’m certainly not questioning the abilities of my client’s children, I will say that assuming your little ones will get a scholarship is not responsible financial planning. What if young Jimmy gets injured, or if little Susan gets bored with the violin? It’s most certainly better to have money saved up just in case things don’t go according to plan.

That might sound a bit pessimistic, so let’s look at the glass half full. Let’s say Jimmy is a superstar and gets a full ride, and Susan does the same. Although my client would still have to pay a bit for living expenses, the cost for both of their educations will be significantly cheaper. If this happened, my client would have hundreds of thousands saved up.

Hundreds of thousands saved up… Hmm, is that a bad thing?

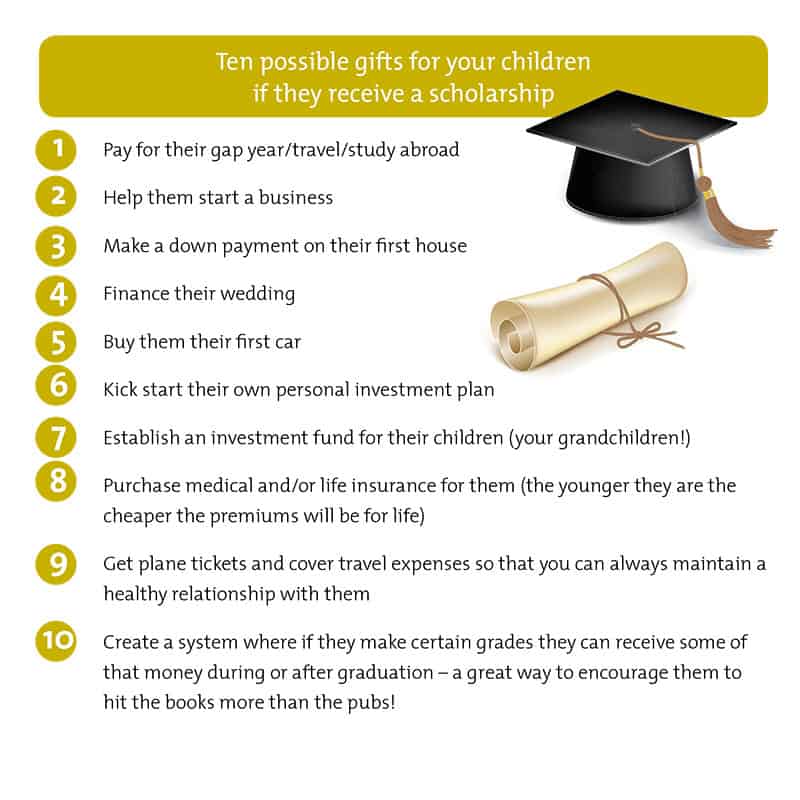

No, not at all! In my entire career I’ve never heard of anyone complain about having too much money. With expert advice and by choosing the right product, your investment that you initially started as an education fund doesn’t have to go towards college. You can use it however you like – to finance your retirement, buy a house, travel the world, etc. Or since it was intended for your children you may like to help them out with something that will give them a leg up in life (see the list below).

If that day comes and your children need every penny of your investment to provide a world class education, then you’ll be happy knowing that you took the initiative to be a responsible parent. Contrarily, if they don’t need it, then you’ll be just as content knowing that you have a nice savings that can be used for anything you want.

Investing (with the right advice and proper plan) for your children’s education is a win win deal: either they’re going to need it, or you’ll end up using it. I guarantee it will be put to good use by one of you!

If you are in the Shenzhen area and would like to learn more about education fee planning, get in touch with me at [email protected] for a free, no-obligation consultation.

About the Author: Dewey (Trey) Archer

Dewey (Trey) Archer has been a Financial Consultant with Infinity Financial Solution, Ltd since 2014. He is qualified by the Chartered Insurance Institute (CII) with an Award in Financial Planning and has been awarded the title of Premier Advisor at Investopedia Advisor Insights. His studies and career have taken him to over one hundred countries, and his international experience has allowed him to add Spanish, Portuguese and Mandarin (along with his native English) to his list of fluent languages. Trey specializes in IRS compliant investments and pensions for American nationals but enjoys using his international background and linguistic skills to work with a vast network of people from all over the globe. Trey can be reached at +86 138 1620 7274 or [email protected]