Item 1 of Ministry of Finance and State Taxation Administration Announcement [2019] No. 35)” (hereinafter referred to as “Announcement No. 35”) in 2019 stipulates that when an individual without domicile makes his first declaration in a tax year, he or she shall calculate and pay the tax according to the estimated number of days of residence in a tax year and the number of days of stay in China within the period specified in the tax treaty according to the contract. Today, we will share how to deal with the individual income tax after the resident individual is converted into a non-resident individual.

DEFINITION

Resident Individuals

Resident individuals for IIT purposes include the following two categories:

- Chinese citizens and foreign nationals who have a domicile in China. This does not include Chinese citizens who reside in Hong Kong SAR, Macau SAR, Taiwan region, or overseas but who do not have a domicile in China.

- Foreign individuals, overseas Chinese and residents of Hong Kong SAR, Macau SAR and Taiwan region who do not have a domicile in China but who have stayed in and China for a total of 183 days or longer in a single tax year.

Non-resident Individuals

Non-resident individuals refer to individuals who meet one of the following conditions: individuals who have no domicile and do not reside in China; or individuals who have no domicile in China and who have stayed in China for less than 183 days in total in a single tax year.

Domicile

Having a domicile refers to maintaining a habitual residence in China for the purposes of permanent residence, family or economic interests, rather than merely owning real estate in China. If an individual resides outside China only for study, work, family visits, travel, etc., and then must return to live in China after the aforesaid activities are completed, the individual’s habitual residence shall be deemed to be in China. Conversely, if an individual resides in China only for study, work, family visits, travel, etc., and then leaves to reside abroad once the aforesaid activities are completed, the individual’s habitual residence shall be deemed to not be in China (such individuals are hereinafter referred to as “non-domiciled individuals”). For example, if a foreign individual purchases real estate in Shenzhen as an investment, the individual will not be deemed to have a domicile in China based merely on his or her

ownership of the real estate.

It should be noted that the concept of “in China” in prevailing Chinese tax laws refers only to China and does not include Hong Kong SAR, Macau SAR and Taiwan region. In the following sections, we will use “in China” and “outside China” to differentiate.

Law and Regulation

According to the provisions of Announcement No. 35, where a non-domiciled individual is predetermined to be a resident individual but ultimately does not satisfy the resident individual criteria due to the reduced number of days he or she stays in China, the individual shall report to the in-charge tax authorities during the period from the day on which he or she fails to satisfy the resident individual criteria to 15 days from the end of the year, recompute his or her tax payable amount as a non-resident individual, and declare the tax amount to be paid retrospectively.

The individual shall not be subject to late tax payment surcharges. Where a tax refund is required, it shall be handled pursuant to the relevant provisions.

EXAMPLE

A is a U.S. citizen who is employed by company B in China at the beginning of 2021 and plans to come to China to work, and the expected work period is from February 1, 2021 to October 30, 2021

So how should company B withhold and pay the individual income tax for A?

First of all, company B should first estimate A’s residence time in 2021 according to the number of days of residence in the country within a tax year as estimated in the contract and the number of days of stay in the country within the period stipulated in the tax treaty when making the first individual income tax withholding and payment declaration for A in the current year.

According to the contract, A qualifies as a resident tax payer, and company B calculates and withholds and pays individual income tax for A as a resident individual. However, the actual situation is different from the estimated situation, A resigns on June 30, 2021 for personal reasons, resulting in A’s actual residence in China for less than 183 days to meet the non-resident individual condition, how should his individual income tax be handled?

According to the provisions of Announcement No. 35, it should be reported to the competent tax authorities between July 1, 2021 and January 15, 2022 for the conversion of resident to non-resident and recalculate A’s taxable amount according to the non-resident individual.

Assuming A is a non-executive, has no foreign income during his employment with company B, salary is 30,000RMB per month, has no special additional deductions, and pays a personal social security of 3,000RMB per month, regardless of mutual tax treaties. How much should individual income tax be from the resident to non-resident?

Resident Tax Calculation

For the period from February 2021 to June 2021, A’s individual income tax is calculated as follows.

Yearly taxable income: 30,000*6-3,000*6-5,000*6=132,000.

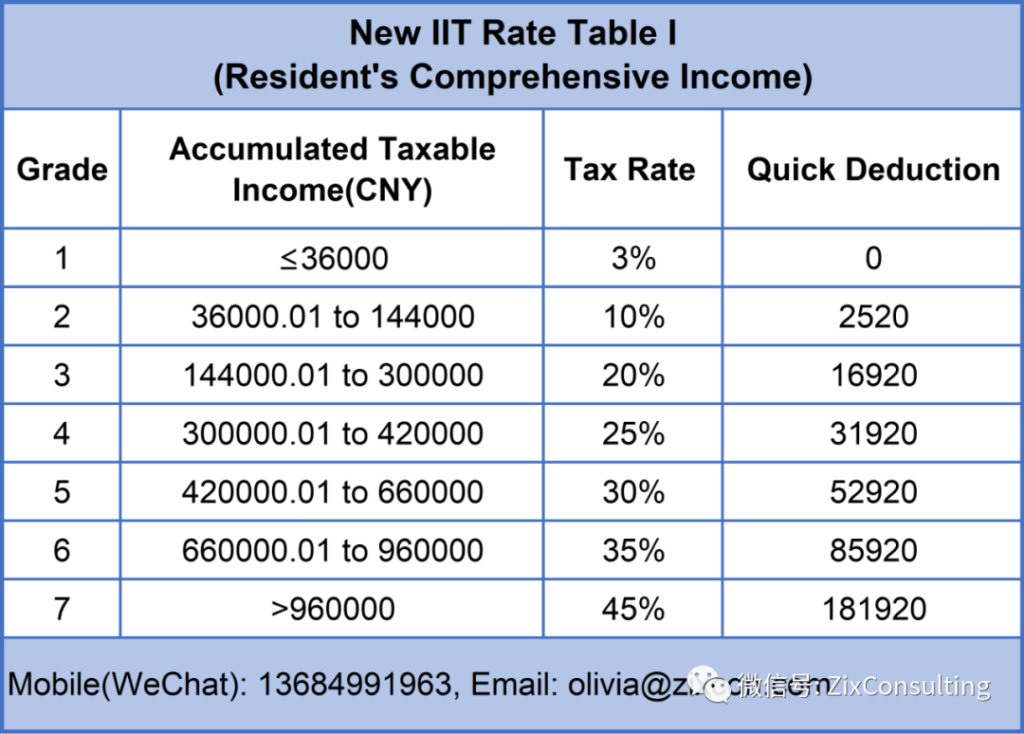

According to Individual Income Tax Rate Table I, the corresponding tax rate is: 10% and the quick deduction is: 2520. Total tax paid from February to June: 132000*10%-2520=10680RMB.

Resident individual income tax rate table:

Non-resident Tax Calculation

However, he needs to recalculate his individual income tax as a non-resident individual because A’s actual period of residence does not qualify as a resident individual. Wages received by a non-resident individual should be itemized on a monthly basis for individual income tax calculation.

Monthly taxable income as a non-resident individual:

30,000-3,000-5,000=22,000RMB.

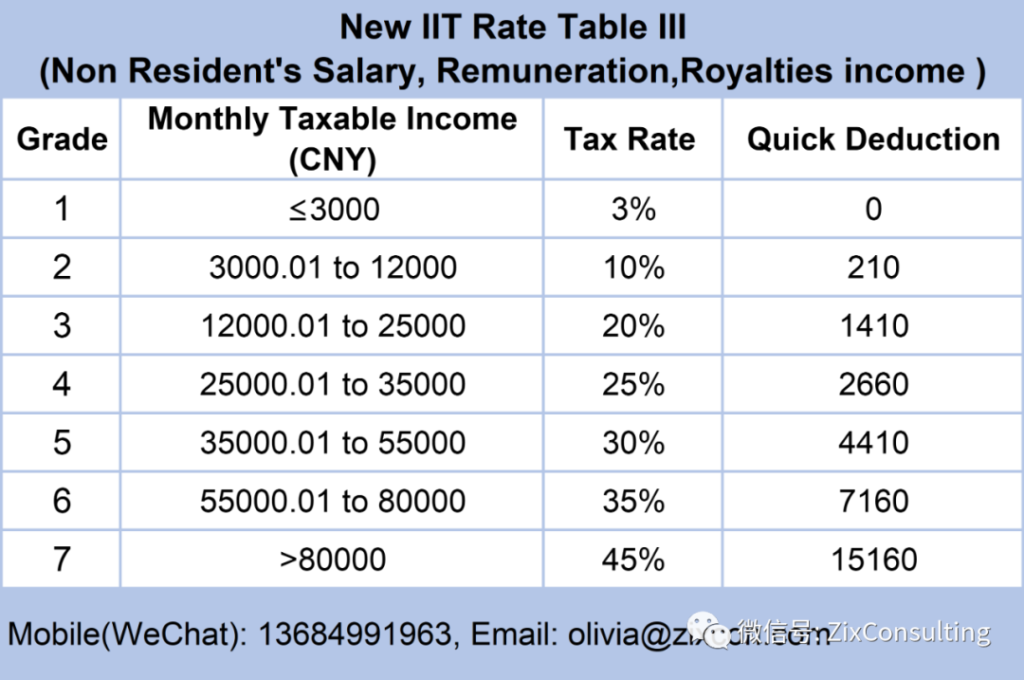

Corresponding tax rate: 20%, quick deduction: 1410.

The monthly tax is: 22000*20%-1410=2990 RMB, and the total individual income tax payable from February to June is: 2990*5=14950 RMB.

Non-resident individual tax rate table:

Extra Tax Needed to Pay

A should pay extra tax: 14950-10680=4270RMB.

Materials

Must go to the in-charge tax authorities to handle it.

Materials are as follows:

1. Individual Income Tax Self-tax Form (Form A) 《个人所得税自行纳税申报表(A表)》;

2. Individual income tax records of the corresponding month;

3. Original and photocopy of foreigner’s ID certificate;

4. If you entrust someone else to handle the application, you need a copy of ID of the declarant (non-resident) and an original power of attorney;

5. Original and copy of the ID card of the company tax operator.

Please reconfirm with the competent tax office for details.

We will share individual income tax treatment from non-residents to residents soon.