Since this year, more and more expats have decided to leave China to return to home country or work in a third country. Today we will share what things should be taken care of before leaving China (Take Shenzhen as an example)?

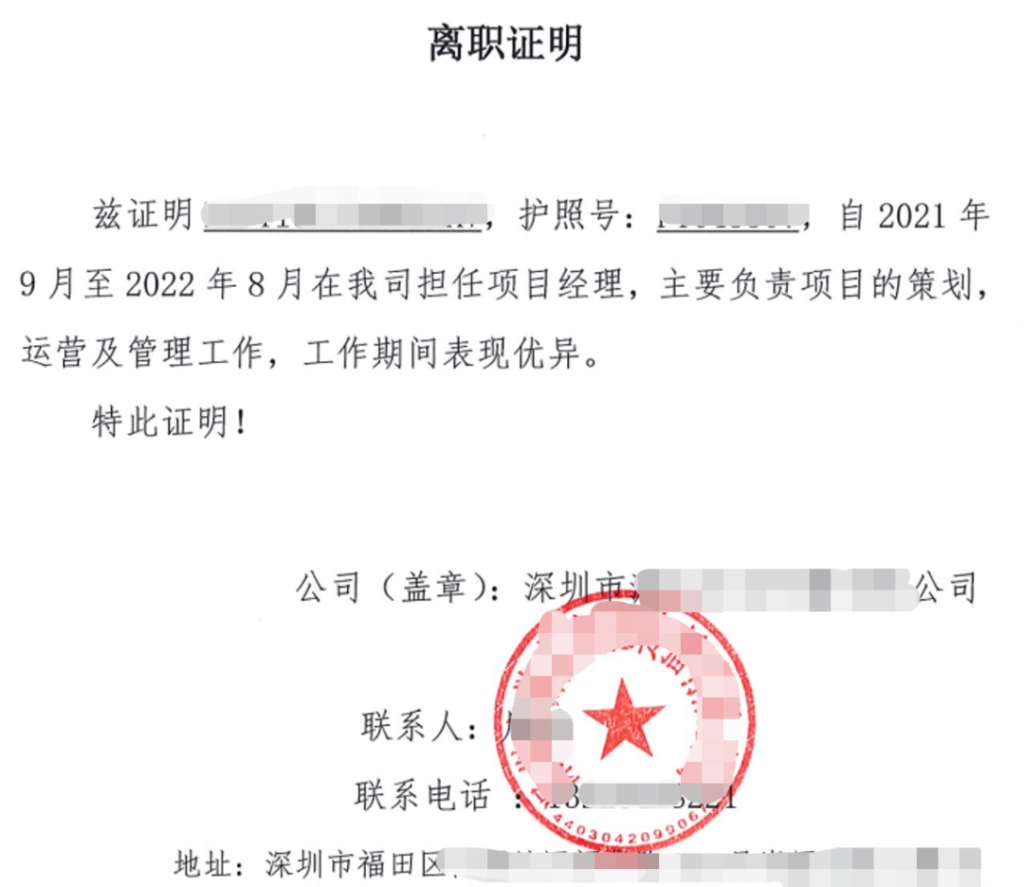

1. Release Letter

Before leaving China, expats should ask for a Release Letter or Employment Certificate. The Release Letter should state your name, passport number, work period (entry and exit date), position, contact information of the company, and be stamped with the company’s official seal.

If you move to another company in China or go back to China to work in the near future, you will probably need this certificate when you apply for a work permit.

The company should issue the Release Letters to the departure employees according to the Labor Contract Law.

Sample

Notarization

It is recommended to notarize the Release Letter or Employment Certificate, as it may be required for future employment or permanent residence application in a third country.

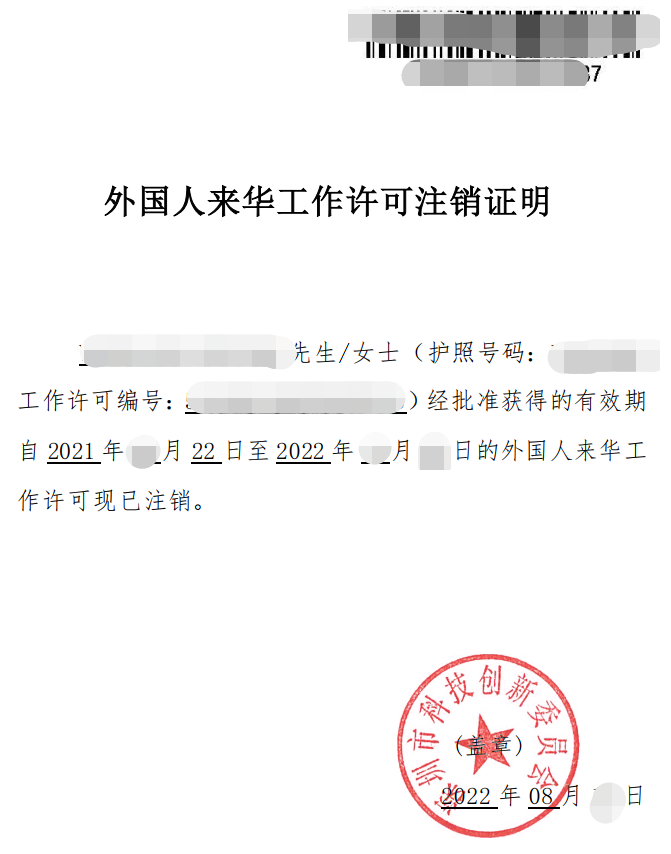

2. WP Cancellation Certificate

There are two conditions:

- Your last working day is the expiration date of your work permit or very close to the expiration date, you do not need to cancel your work permit (because you only can submit an application for cancellation of work permit few days before your last work day).

- You have to cancel your work permit if your last working date is long before the expiration date of your work permit, in which case you have to obtain a certificate of cancellation of your work permit issued by the Bureau of Foreign Experts. This certificate is required for transferring work permit in China.

- Cancellation Materials

- Work permit cancellation application form.

- Proof of separation or release letter.

- No meeting commitment letter (if you submit this, you can complete the application online).

Sample

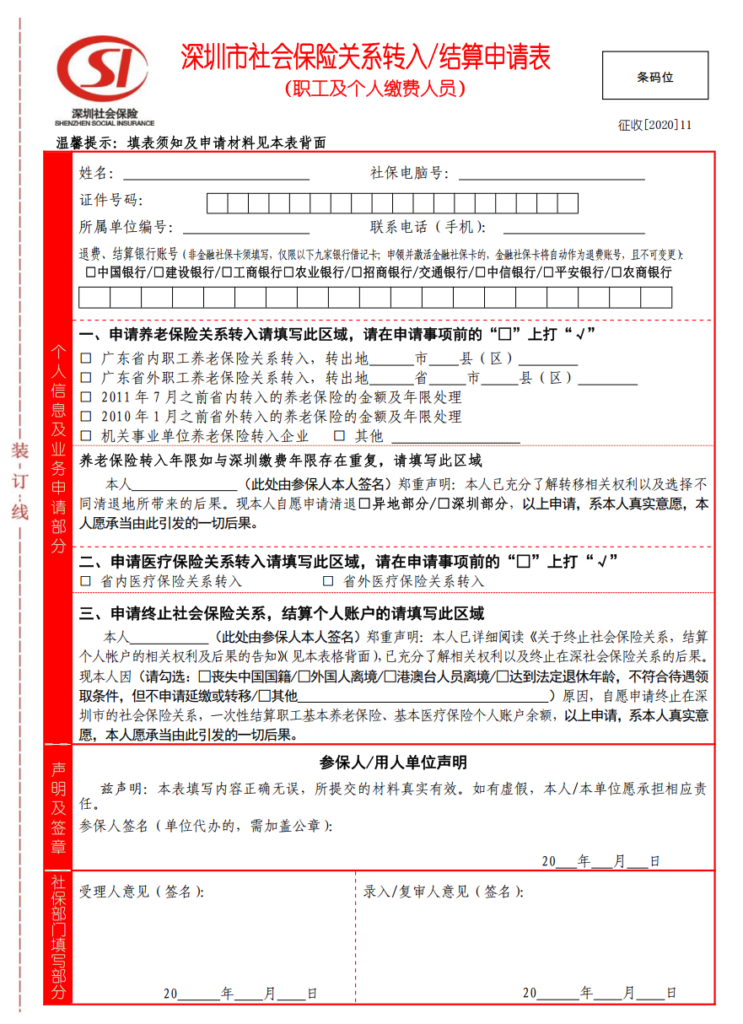

3. Withdraw Your SI Balance

Please note that the prerequisite for applying for social insurance withdrawal procedures is that the company has stopped your social insurance in system. Usually, if you pay social insurance in the same month, the company can only operate the system to stop in the last one or two days of the month, so please plan your time wisely.

There are two ways to apply, one is offline, the other way is online.

1. Offline Application Materials

- Passport

- Bank card (Financial social security card is needed if you have)

- Work permit cancellation letter or release letter

- Financial social security card, no need to provide if don’t have.

- Application form (signed by the applicant, the official seal must be affixed if company applies for the employee)

The form is as follows:

2. Online Application Materials

If you registered an account in the social security system and all the information in the social security system is correct, you can also apply for withdrawal online, scan the QR code to login in the system:

The path to apply is as follows:

3. How Much Can I Get?

You can log in to your personal social security system account to check, or you can go to Social Insurance Bureau to check. All parts paid by employee can be withdrawn.

If I left China, can I still apply?

We can apply as an agency for you, please contact us if you need.

4. Withdraw Housing Funds

If your company has purchased a housing funds for you, you can also withdraw the balance of your housing funds before you leave China.

Like withdrawing social insurance, you can apply online or offline. It is recommended to apply offline, as there is no right option for expats online and you usually need to wait for several months to receive the money.

The premise to apply online is you signed the Self-service agreement with the housing funds bank.

Online withdrawal application channel: “粤省事” or “iShenzhen” housing funds section.

Materials for offline withdrawal:

- Original passport

- Original housing funds card (other bank card can be provided if don’t have)

- Authorization and Commitment Form (Filled out in the bank on site)

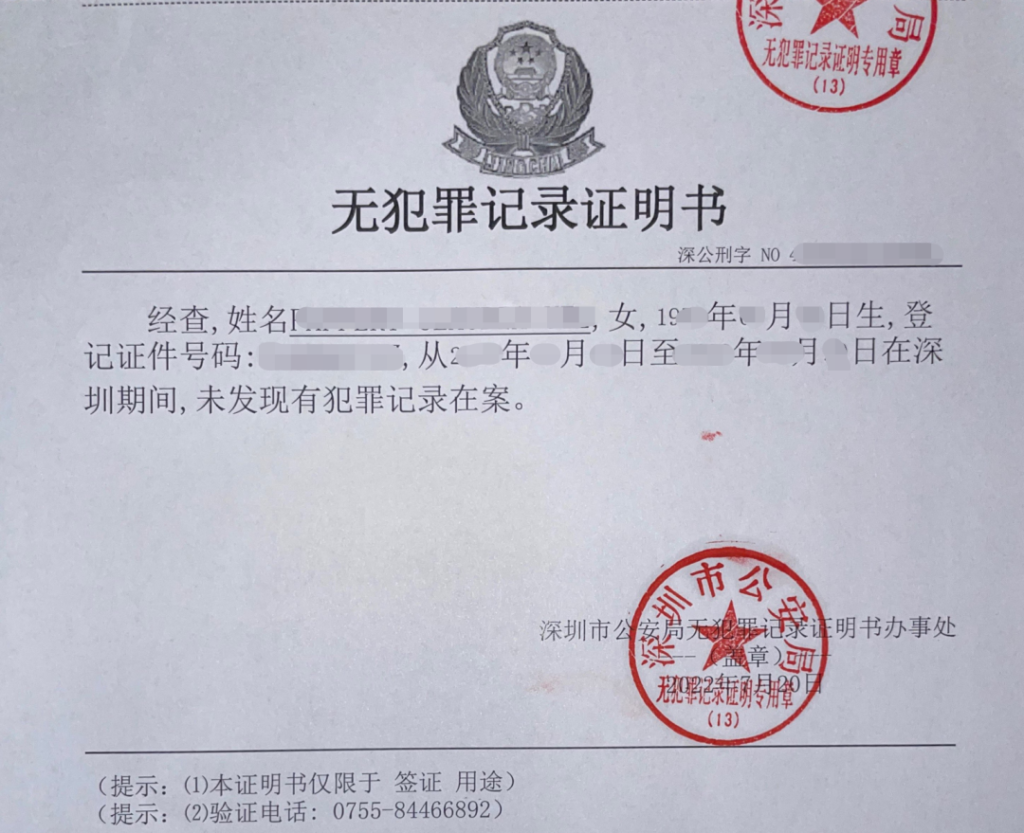

5. Non-criminal Records

In Shenzhen, usually applicants need to apply for Non-criminal recrods certfiicate on site. Documents provided by the proxy will be more complicated.

1. Requirements

Expats who have lived in Shenzhen for at least 6 months continuously.

2. Application Materials

- Original passport.

- Temporary accommodation registration form (please remember to update it every time you change visa, living address, passport, ect).

- Application form (fill out and sign on site)

Processing time: 3 working days

Address: Fuzhong 3rd Road Civic Center Administrative Service Hall West Hall, Shenzhen Futian District.

3. Documents Needed by an Agency

- Passport photo page and Chinese visa pages, which must be certified by the Chinese Embassy or Consulate.

- Temporary Accommodation Registration Form.

- Power of attorney, which must be certified by the Chinese embassy or consulate.

4. Notarization

It is recommended that you go to a notary public to notarize the non-criminal certificate because many clients need to provide a notarized one or certification from a foreign embassy or consulate in China when they apply for a work visa, study visa or permanent residence in a third country after leaving China. Will be easier to get foreign consulate authentication if you have a notarization in the near future.

5. Sample

If I left China, can I apply?

We can apply as an agency for you, please contact us if you need.

Our company can handle the whole process of getting the non-criminal certificate, notarization, legalization of the Ministry of Foreign Affairs and authentication of foreign consulates in China.

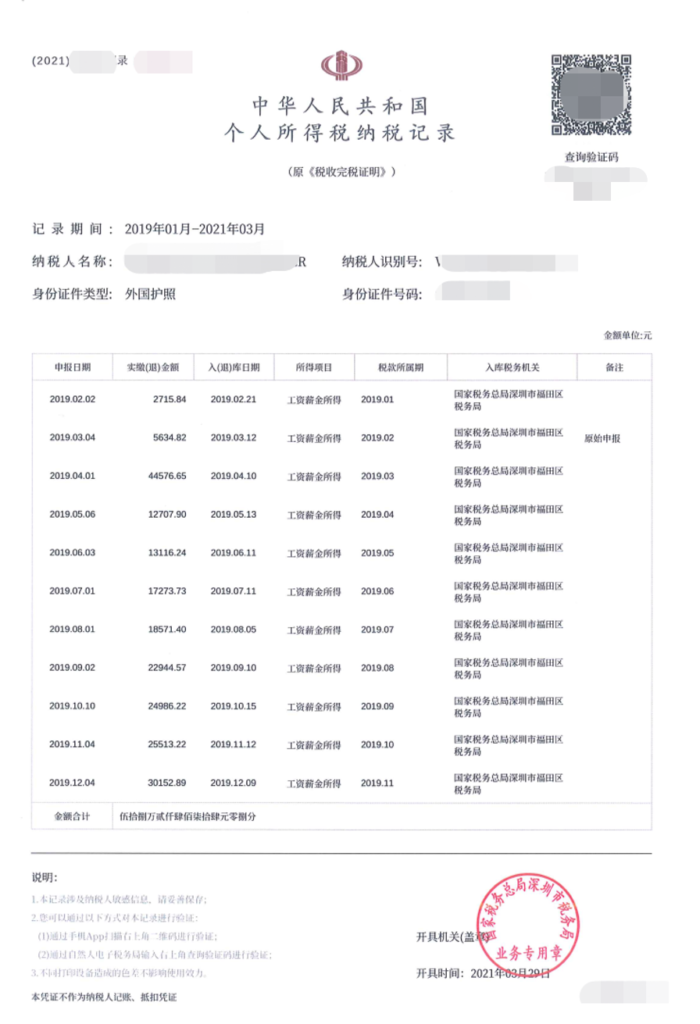

6. Obtain IIT Certificate

How to get an individual income tax certificate in Shenzhen:

1. On “个人所得税” App

“Individual Income Tax” 个人所得税App. You can only get tax certificates for the period after January 2019.

Can download the app through scanning the QR code:

Path:”首页-常用业务-纳税记录开具”。

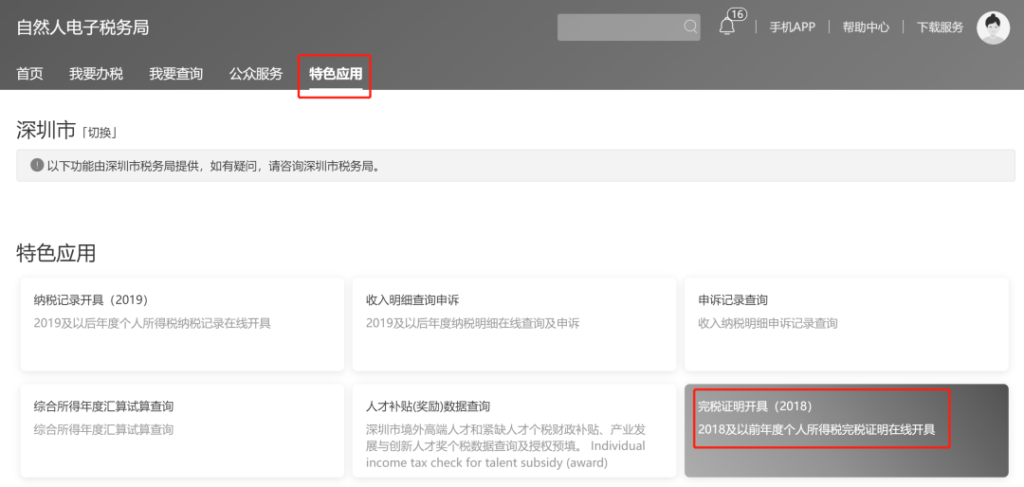

2. Website of Taxation Bureau

Scan to login in:

Path to get tax certificates after 2019: “特色应用-纳税记录开具”.

Path to get tax certificates befor 2019: “特色应用-完税证明开具”.

3. Print in Tax Bureau

Can go to Tax Bureau to check.

4. Sample

Number 1 and 2 require you to register an account (foreigners need to apply for registration code at the window of tax office or apply registration code online).

If you have already left China, you can also entrust us to register and print the individual income tax certificate.

7. Handle Individual Income Tax

The responsibility of individual income tax in China is employee, so before you leave China, you need to check your tax payment record in China to confirm whether your employer has withheld and paid the corresponding individual income tax for you in full, if not, you need to confirm with your employer and make up for the tax payment, otherwise you will incur late payment fees and penalties for missing tax payment, and affect your credit status in China. It is recommended to have your individual income tax calculated and verified by a professional or institution.

1

The change of your taxpayer status: resident to non-resident, or non-resident to resident.

If there is a change in taxpayer status, it will lead to a discrepancy between the tax paid and the tax payable, in which case you need to go to the tax office to handle before you leave the country.

Welcome to follow our public account “Zixconsulting“, we will write an article to explain the individual income tax issues after the tax payer’s status changes.

2

If you are a resident taxpayer and you use the eight eligible allowances policy to deduct tax, you can get a tax refund through annual settlement next year, you need to prepare the evidence in advance. E.g., you need to collect the rent invoices before you leave China if you use the eligible house allowance, so that you can provide the supporting documents to the Tax Bureau when you apply for tax refund through annual settlement next year.

8. Transfer Money

Due to foreign exchange control, when you transfer your salary and wages from China to foreign bank accounts, banks usually require individual income tax certificates. If you have other income, please ask you’re the bank what material is required.

If there is no future payment to be received (e.g., social security refund, housing funds refund and government subsidies), then you can cancel your bank card.

9. Unlink Your Phone Number

Your phone number in China is just about the most important information you can get in terms of activating your bank or using apps like Alipay or WeChat. If you do not cancel your phone number before you leave China, you may encounter problems, especially if it is associated with your passport number.

On the other hand, forgetting to cancel or disassociating your phone number from your WeChat ID can be risky. If your phone bill is not paid for six months, it will be registered as a new number and someone else will be able to log in to your WeChat. Canceling your phone number also means deleting your Alipay account. Since Alipay contains all your payment transactions or bank card information, it is also important to deal with it before you leave.

10. Cancel Your SIM Card

It may not seem important to cancel your SIM card when you leave China, but if you want to return to China in the future and get a new one, you should never forget it. If the SIM card is not cancelled, it will continue to be charged by the provider in China. In addition, after 90 days, the provider will take back the number and blacklist you. This will cause trouble for you to apply for a new SIM card in the future.

11. Rental Issue

Expats need to communicate with their landlords before leaving China to deal with the rental deposit or reimbursement of housing allowance from your company, it is best to plan ahead to deal with this due to visa timing issues.

Please note:

Please do not cancel your bank card and cell phone SIM card, because the application time for the subsidy is the end of the following year if you are eligible to apply for the individual income tax subsidy for foreign high-end talents in GBA (this year’s policy is not issued yet, please refer to the following tweet for last year’s policy:2020 Tax Subsidies for High-Level Expats).

You will not be able to apply for it if you have cancelled your cell phone SIM card and bank card (our company encountered a real case last year: the applicant left China and cancelled his cell phone SIM card, so he could not register his accounts in the Human Resources system and the Taxation Bureau, and finally he could not apply for subsidy of more than 300,000CNY).